IQBroker platform withdrawals

As the person can fund the account for investments, it is also possible to withdraw the results of successful deals. The IQBroker service offers multitude of convenient ways for money transferring to the bank or e-wallet accounts. After studying the terms for each method carefully, it is easy to define the most comfortable way of fund withdrawal from the trading platform.

Money withdrawals from IQBroker

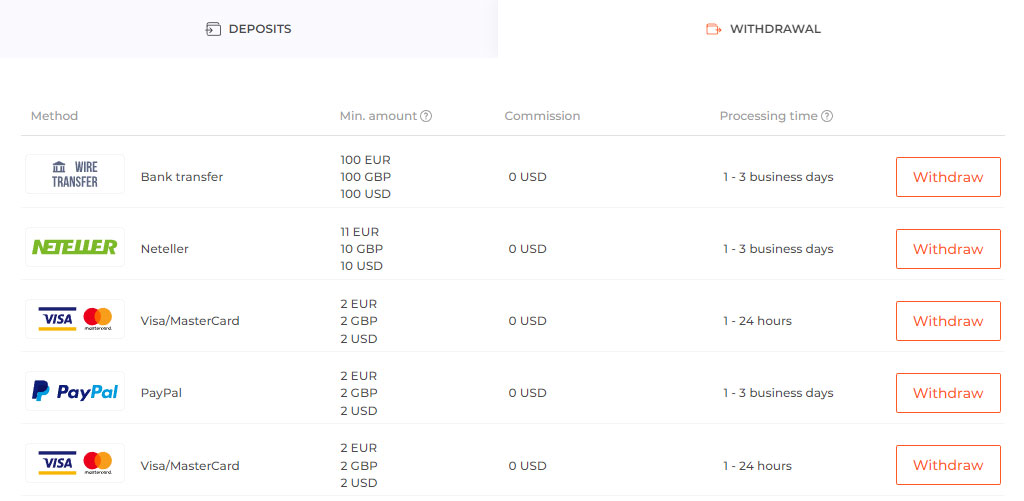

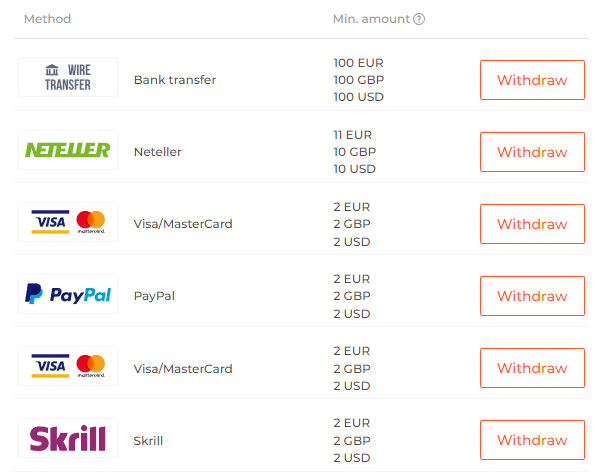

To access the transfer menu, the user has to choose the “Balance” tab and select there the button responsible for withdrawals. In it, all available methods are listed which would allow to receive the funds to the comfortable payment systems, with notes about estimated processing and fees. Also, the different gateways have their own minimal limits which should be taken into account.

It is important to notice that the dates are rather approximate, heavily influenced by trader’s location and possible technical delays. Out of the available options, the most popular one is direct Visa/Mastercard withdrawal to bank cards due to comfortable conditions. The least used selection is bank wire transfers which has various demands, starting from high minimal margin and ending with long waiting period.

In case when nothing arrives even after five business days, the person has the legit right to contact the customer support department and request its help. The staff members will provide the necessary answers as soon as possible after studying the issue.

Estimated withdrawal period

While some methods provide instantaneous transactions from the platform, other collect the legal approvals and take longer time for sending the funds safely. It is safe to say that the average waiting period makes three days since the request creation. Sometimes, the detail with “business days” should be taken into account, as it may prolong the wait to another couple of days.

Withdrawal limits per transaction

Before confirming the withdrawal, it is necessary to study the set limits from the method detailed description. There is no actual margin selected by the IQBroker platform itself, allowing to withdraw both small sums or significant amounts of money at one go.

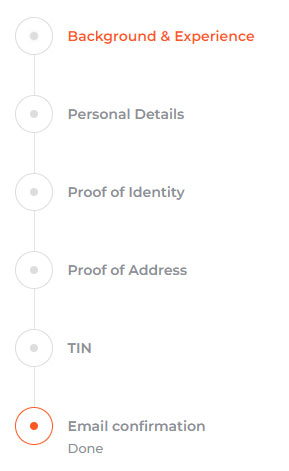

Requirements for accepting withdrawals

Only after completion of verification processes and real account unlock, the trader gets the opportunity to deal with profile transactions. Before this, there is no way that the person is allowed to complete the transfers while using IQBroker services.

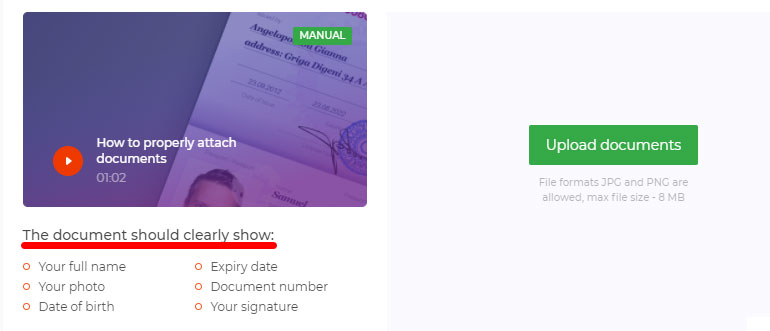

Documents required for IQBroker transactions

There is a constantly changing set of documents which are applicable for confirming the trader’s status. In some places, only the passport can be accepted, while other regions enable the alternatives like travel documents or driving license. The updated options are listed on the verification page individually, allowing to prepare only the most necessary proofs of identity.

To have the document approved, the photo of the selected certificate should be clear, without any suspicious blurs or grain effects, all the words have to get the high-res quality to be read. All the fields for document approval also need to be uploaded if necessary.

For the bank cards, there is also the separate verification step which documents the most essential information about it. The only covered detail there should be the CVV security code which has to be known only by the account owner. It is not necessary to show the full number first six and last four digits should be more than enough for identifying the owner.

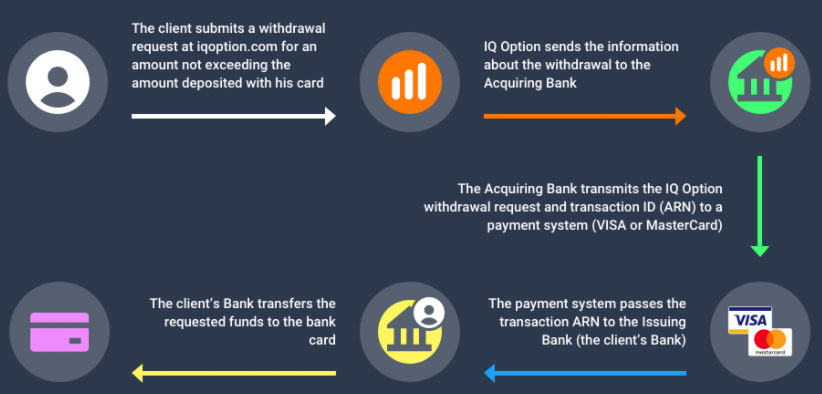

Bank card withdrawals

Before being received by the trader, the transaction completes a complicated route in order to get the approval with direct transfer. First, after forming the request, the funds go to acquiring bank, getting the approval there, processed next to the issuing bank with the ID formed by Visa/Mastercard services. The final destination is the card from issuing bank, which takes no fees but compensates it with long waiting time. Depending on the region, the transfer takes three days with or without including the weekends and holidays.

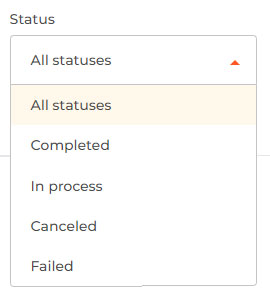

Withdrawal statuses

There are five main categories the transactions can fall into:

- Requested – the initial status after withdrawal request.

- In-process – accepted by the administration for reviewing, charging the funds from real account.

- Hold – paused because of the verification, will proceed further after administration approval.

- Canceled – denied on one of the stages, requiring the intervention from customer support.

- Funds sent – successful transferring outside of the IQBroker system.

When the last status is shown, then it will take around 24 hours to be finally accepted by the payment system. Just to be safe, it is recommended to visit the withdrawal history page occasionally.

What does ARN mean

Decrypted as “Acquired reference number”, this term is used for interbank transfers so that the payment can be tracked further. For international transactions, it is a valuable attachment that allows to follow the funds path through several systems as a whole.

Reasons for withdrawal rejection

Occasionally, there can occur the unexpected or predictable rejections for the funds withdrawing. Usually, this happens because of:

- Incomplete verification procedure

- Incorrect payment details

- Problems with issuing bank

- Transfer mistake blocking the fund flow

- Unexpected technical issues

If there is no explanation which applies to platform status, then the customer support department should be contacted immediately. With the right to request the payment details from partnering systems, the staff will soon introduce the explanation and a possible solution to it.